Panel to review economic capital for future earnings

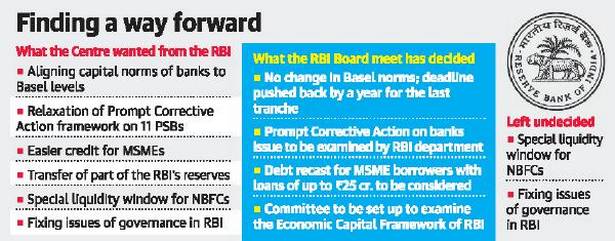

The tension between the government and the Reserve Bank Of India appeared to have defused for the time being with both parties agreeing to settle for a middle ground at the end of an over nine-hour board meeting on Monday.

The most contentious issue that the central bank and finance ministry locked horn was the issue of RBI’s capital. Now, while RBI has agreed for setting up of an expert committee on the economic capital framework (ECF) its mandate is restricted to future earnings and not the existing reserves, sources privy to the board deliberations told The Hindu. The membership and terms of reference of the committee will be decided by the finance minister and RBI governor.

“The board decided to constitute an expert committee to examine the ECF, the membership and terms of reference of which will be jointly determined by the Government of India and the RBI,” RBI said in a statement

Sources indicate there were detailed presentation by RBI on the issue of economic capital as well as other issues like prompt corrective action framework.

On the PCA, Board for Financial Supervision (BFS) of RBI will review the norms and will take a call if some of the parameters like net non-performing asset (NPA) ratio could be relaxed so that some of the banks come out of the PCA. There are 11 public sector banks out of 21 that are on PCA. The BFS consists of governor, four deputy governors and few other board members.

Another significant decision was relief to the micro, small and medium enterprises – the sector which is badly hit due to twin blows of demonetisation and patchy implementation of Goods and Service Tax (GST).

“The Board also advised that the RBI should consider a scheme for restructuring of stressed standard assets of MSME borrowers with aggregate credit facilities of up to ₹250 million [₹25 crore] , subject to such conditions as are necessary for ensuring financial stability,” RBI said.

On the issue of capital adequacy ratio, after much deliberations to reduce it to 8%, it was finally retained at 9%. However, the deadline for implementing the last tranche of 0.625% under the capital conservation Buffer (CCB), has been extended by one year, that is, up to March 31, 2020.

Two other important issues that could not be discussed — liquidity for non-banking financial companies and governance issues of RBI- and those will be taken up in the next board meeting, scheduled on 14 December, sources said.

Sources added, the meeting board meeting proceeded amicably contrary to expectation. The tension between RBI and the government was started with the latter referred to section 7 of the RBI Act for consultation on these issues. Section 7 gives the power to the government to issue direction to RBI.

“The objective was to takeout RBI from the front page of newspapers,” said a person privy to the board discussions, indicating that proceedings were smooth unlike the last meeting held on October 23